LayerZero (ZRO), ORDI (ORDI), Systemic Risk

Systemic Risk in Cryptocurrency Markets: Understanding LayerZero and Ordi

The world of cryptocurrency has been abuzz with excitement and speculation in recent years, but beneath the surface lies a complex web of risks that could have far-reaching consequences for investors and markets as a whole. One aspect of this risk landscape is systemic risk, which refers to the potential for a widespread financial crisis to spread across multiple industries and economies.

In this article, we’ll dive into two specific aspects of the cryptocurrency markets: LayerZero (ZRO) and Ordi (ORDI). We’ll examine what these terms mean, how they relate to each other, and why they pose significant systemic risk in the cryptocurrency space.

LayerZero

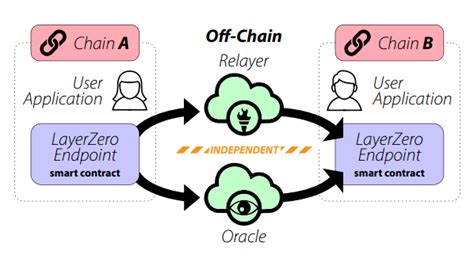

LayerZero is a project that aims to bring a new layer of security and transparency to blockchains. At its core, LayerZero is an architecture for creating trustless, permissionless blockchains with built-in self-executing contracts and decentralized automated market makers (AMMs). This structure allows developers to create complex trading mechanisms without the need for intermediaries or centralized authorities.

A key feature of LayerZero is its ability to facilitate cross-chain interactions between different blockchain networks. By enabling seamless exchange and settlement, LayerZero reduces the reliance on traditional intermediaries such as exchanges, which can introduce systemic risk due to their role in facilitating market manipulation and providing liquidity.

However, the emergence of LayerZero also poses the risk that it could be hijacked by malicious actors or used for their own benefit. If one party were to exploit the security flaws inherent in this architecture, it could potentially disrupt the entire ecosystem and cause widespread instability.

Ordi

Ordi is a cryptocurrency project that focuses on creating a decentralized platform for peer-to-peer transactions without the need for intermediaries such as banks. The Ordi protocol allows users to send and receive funds directly from each other without going through any transaction processing or intermediaries.

One of Ordi’s key features is its emphasis on security, scalability, and decentralization. Using advanced cryptographic techniques and smart contract functionality, Ordi aims to create a robust and resilient platform that can withstand even the most extreme market conditions.

However, the underlying technology used by Ordi also raises concerns about systemic risk. In particular, the use of private key-based encryption creates the risk that unauthorized access to user funds could compromise security. Additionally, relying on a central authority (the network administrator) to manage transactions and ensure network stability could introduce a single point of failure, making the entire system vulnerable to collapse.

Systemic Risk in Cryptocurrency Markets

The emergence of LayerZero and Ordi highlights several systemic risks that exist in cryptocurrency markets:

- Decentralization: Relying on a decentralized architecture for peer-to-peer transactions creates vulnerabilities if any node or entity fails.

- Intermediary Risk: Exchanges, custodians, and other intermediaries can introduce systemic risk due to their role in facilitating market manipulation, providing liquidity, and settlement processes.

- Security

: The use of private key encryption and reliance on central authorities poses security risks if not properly secured.

- Liquidity Risk: The need for decentralized platforms to maintain high levels of liquidity introduces systemic risk related to market volatility and price stability.