Binance, systemic risk, DEX

“Crypto, Binance and Systemic Risk: Understanding the Complex Web of Decentralized Finance”

The world of cryptocurrency has evolved rapidly in recent years, and its popularity shows no signs of slowing down. At the forefront of this revolution is the popular cryptocurrency exchange, Binance. However, behind the scenes lies a complex web of systemic risks that have raised concerns among investors and regulators. In this article, we will dive into the world of cryptocurrency, explore the role of Binance, and examine the implications of decentralized finance (DEX) for the global financial system.

The Rise of Cryptocurrencies

Cryptocurrencies such as Bitcoin and Ethereum have gained acceptance in recent years, with many individuals and institutions investing heavily in these digital assets. According to a report by Deloitte, the size of the cryptocurrency market is expected to reach $2.5 trillion by 2023, with Binance being one of the major players in this space.

The Rise of Binance

Founded in 2017 by Changpeng Zhao (CZ), Binance has grown exponentially over the years, becoming one of the largest cryptocurrency exchanges in the world. The exchange offers a range of services including trading, lending and investing, making it an attractive option for investors looking to diversify their portfolios.

However, behind the scenes lies a complex web of systemic risks that have raised concerns among investors and regulators. The rapid growth of cryptocurrencies has created a sense of uncertainty, with many wondering whether this new asset class is truly stable or just a speculative bubble waiting to burst.

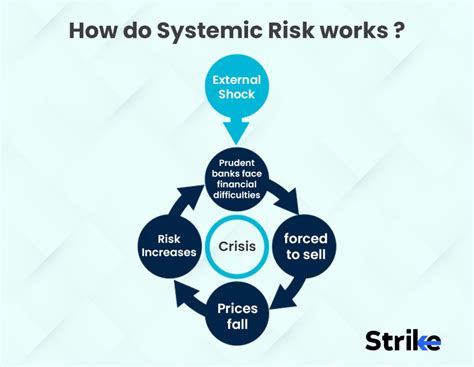

Systemic risk: A growing concern

Systemic risk refers to the possibility that a global crisis will affect all parts of the financial system, including central banks and governments. The rise of cryptocurrencies has highlighted these risks, as the decentralized nature of many cryptocurrencies makes them vulnerable to manipulation by malicious actors or malware.

For example, the collapse of Mt. Gox, a Japanese cryptocurrency exchange that was once one of the world’s largest, highlighted the vulnerability of centrally backed cryptocurrencies in 2014. The stock market crash resulted in the loss of more than 800,000 bitcoins, worth billions of dollars.

Decentralized Finance (DEX)

Decentralized finance (DEX) refers to a new type of financial system that runs on blockchain technology. DEXs allow users to borrow, lend, and trade cryptocurrencies without relying on intermediaries or centralized exchanges like Binance.

The use of DEXs has grown in popularity in recent years, with many institutional investors noticing their potential benefits. For example, decentralized exchange Uniswap, founded by Vyeet Bio in 2018, has become one of the largest cryptocurrency exchanges in the world.

However, the rise of DEXs has also raised concerns among regulators and investors. The decentralized nature of these platforms makes them vulnerable to hacking and other security threats, highlighting the need for a robust regulatory framework to ensure investor protection.

Conclusion

The world of cryptocurrency is complex and rapidly evolving, and systemic risks are a growing concern. The rise of Binance highlights the potential of this new asset class to disrupt traditional financial systems, while decentralized finance (DEX) has shown its potential as a more transparent and efficient alternative to centralized exchanges like Binance.

However, it remains to be seen whether these platforms will ultimately prove stable or susceptible to manipulation. As the world of cryptocurrency continues to evolve, it is crucial that regulators and investors take steps to mitigate systemic risks and ensure investor protection.